Sept 20 - AI Liability Insurance, Hyperpolation, DeFi Hearings, Rate Cut, Ownership mindset

🎧 Listen to this on the S3T Podcast!

In this Edition of S3T:

- 🐻 Fed Rate Cut: The Fed made a significant half-point interest rate cut as job creation slows, with Jerome Powell noting it's something that "bears watching."

- 📈 Market Reaction: The S&P500 hit a new record, rising 1.7%, while Bitcoin surged 5%.

- 💡 AI Model Limits: AI models like OpenAI's struggle with "Hyperpolation," highlighting the challenges of generalizing beyond existing data.

- 🎲 AI Liability Insurance: Companies need to ask 7 key questions when purchasing AI liability insurance to manage uncharted risks effectively.

- 💼 DeFi vs. TradFi: Congressional hearings reveal the difficulty in regulating DeFi with traditional financial laws due to the lack of intermediaries in DeFi transactions.

- 🏦 Crypto Challenges: Despite crypto's potential for better privacy and accountability, issues like Wells Fargo's money laundering highlight that traditional finance also has significant challenges.

- 🔄 Ownership Mindset: Cultivating an ownership mindset in vendors can lead to deeper, long-term relationships and success by aligning with their clients' missions.

Opinions expressed are those of the individuals and do not reflect the official positions of companies or organizations those individuals may be affiliated with. Not financial, investment or legal advice, and no offers for securities or investment opportunities are intended. Mentions should not be construed as endorsements. Authors or guests may hold assets discussed or may have interests in companies mentioned.

🐻Bears Watching

This week the Fed finally cut interest rates, and did it big with a half point rate cut as job creation continued to slow - something Jerome Powell says "bears watching." Interesting choice of words. 😎 The S&P500 hit a new record, jumping 1.7% while Bitcoin jumped 5%.

This chart shows headline inflation rates over the past 5 years. It suggests that inflation went up and then was nicely arrested and brought down for a soft landing thanks to interest rate magic.

At the same time consumer sentiment is still very poor, as noted by University of Michigan's Consumer Survey:

Sentiment shifts

There is also difference between perceptions on the left and right, as noted in the graphic below:

Related: Goldman Sachs analysis of Harris and Trump economic plans.

AI Model Performance Boundaries

Hyperpolation & the limits of models trained on publicly available data

If you've noticed that that the "reasoning" of OpenAI's new ChatGPTo1 / Strawberry model seems overly chatty and shallow, Toby Ord may have an explanation.

Ord's new paper Interpolation, Extrapolation, Hyperpolation: Generalising into new dimensions (PDF) focuses on the concept of "Hyperpolation" as the attempt to hyper-extrapolate new insights or conclusions beyond what can be reliably inferred from existing data. Ord notes that human creativity seems to do this in useful or inspiring ways in the arts and even sciences, but that current AI systems struggle to emulate this capability beyond simple extension of imagery.

Interestingly there are AI systems that can do this task — systems that are trained on (image, movie) pairs and have learnt how to hyperpolate from an image to how that image would evolve.

— Toby Ord (@tobyordoxford) September 10, 2024

Here a system starts with the leftmost images and hyperpolates forwards 3 more frames:

14/ pic.twitter.com/qOCrlv3N0q

As Azeem Azhar puts it, AI is currently unable to "create or explore fundamentally new conceptual spaces and dimensions that are undefined by its existing data."

This highlights a critical limitation of the current foundational models released by the likes of OpenAI, Anthropic, Google etc:

- The data that a model was NOT trained on represents an important boundary line to be VERY aware of.

- If a model was not trained on data of a specific domain, then that model should not be used to derive insights about that domain.

For more context see my Strawberry test results and notes on the reasoning capabilities of AI (which includes some updates since the original notes shared last week).

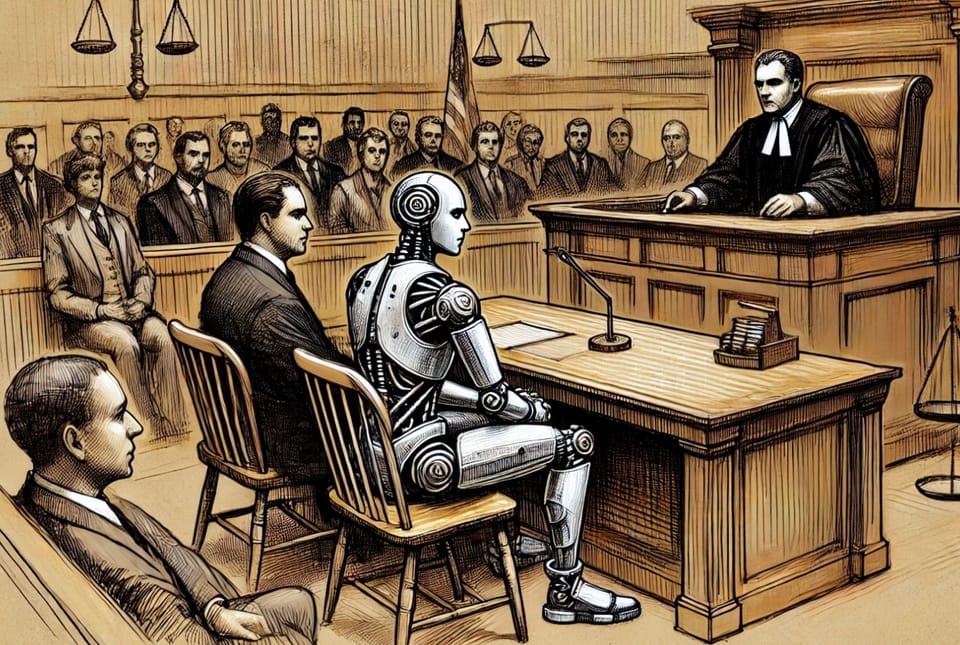

🎲 What to expect when you purchase AI Liability Insurance

As leading firms roll the dice with their initial AI solution launches —Generative AI or otherwise—they come face to face with the reality that AI liability is uncharted territory. The tech and IT service industry - at least the portions dabbling in AI - are looking for ways to minimize their liability:

- transfer it to others, and / or

- prevent others from transferring liability to them.

In this special segment, learn 7 questions corporate risk management teams should ask when purchasing AI liability insurance. These questions can help teams address both the uncertainty of AI liability and the current low-maturity status of of AI insurance policies. They also can help companies factor risk (and cost of coverage) into the business cases they should be doing prior to investing in delivery of new AI products or capabilities.

Key takeaway: Business insurers have not yet figured out how to price or manage the risks of AI. They don't yet have established views on what behaviors would keep a policy holder in safe territory - to either prevent an undesired event, or to warrant a payout if an undesired event occurred.

Companies selling or using AI can better manage risks by using 7 questions to engage insurers and create a stronger, more effective blend of coverage and policy safeguards. Keep reading here:

TradFi DeFI who's the dirtiest of them all?

Congressional Hearings on Decentralized Finance.

Amanda Tumenili, attorney at the DeFi Education Fund opened with an explanation of what's new and why it can't be regulated with old rules:

"The existing approach of trying to apply rules of TradFi to DeFI will not work. The traditional financial system requires intermediaries to function. Brokers affect stock trades, and clearing houses settle transactions, and that means that we need to trust intermediaries to do their jobs reliably and honestly, and the existing rules evolved to prevent the abuse of our trust.

But DeFi doesn't use intermediaries. If I want to swap two digital assets using a DeFi protocol, there is no broker, and there is no clearing house. DeFi's existence - the very reason that this technology was developed - was to eliminate the need to rely on intermediaries and empower people to transact directly with their peers. Existing law assumes that there is some identifiable entity that can take possession of my funds, collect information about my transaction, and even block a trade, but that entity does not exist in DeFi."

Good summary of the hearing with audio clips in the Bankless Sept 13 podcast.

The hearing underscored the degree to which Congress is failing to educate themselves on emerging technology. Several members of Congress focused on the bad actors in crypto, completely missing the improved protections and forensic mechanisms crypto offers over traditional finance (and that traditional finance has significantly more abuse and fraud than crypto).

Paul Barron's interview with Amanda Tuminelli provides a helpful deep dive on Crypto and DeFi basics that some members of Congress are struggling to get their heads around. This interview is a really good educational discussion with clear explanations.

Takeaway: it's important to help Congressional members across the political spectrum understand emerging tech - and specifically the advantages crypto offers for better privacy and better accountability over what is available in traditional finance.

🏦 Surprise! Crypto not the only space with bad actors

Sort of poetic justice: just after the hearing, news broke of Wells Fargo's money laundering problems. Enforcement action details here.

Related: the SEC seems to be backtracking on its confusing term "crypto asset security" and its previous oft repeated claim that crypto tokens are securities.

Photo by Christina @ wocintechchat.com / Unsplash

How to cultivate an ownership mindset in vendors and partners

Featuring one of the learning segments from the S3T Change Leadership Learning Series, available to paying members.

Ultimately your goal is to inspire your vendors to go beyond being simply transactional, to being purpose-driven - like you are. Let them see the opportunity they have to be part of something that has a clear positive impact.

Yes, your vendor has a business to run, but here's the reality: your vendor's business will run better with more impact if they're deeply engaged with your mission.

Ultimately an ownership mindset is good for both you and the vendor. You're in effect offering them the chance to develop a deep affinity with your firm - the kind of deep affinity that ensures long-term relationships and long-term success.

Vendor-client relationships - especially where technology is involved - thrive on two things: clarity and affinity. When you and your vendor are clear about the goal and you both have a common affinity for the positive impact that the goal is intended to achieve, you're both in a better position to succeed.

🔒Learn the 4 top ways to kindle an ownership mindset in your vendors and partners, and unlock the secret superpower of an ownership mindset.

🙏 Thank you for reading and sharing the S3T newsletter with others! Reach out to me on LinkedIn - love to hear from you. Have a great weekend and a great week ahead!

Member discussion