Navigating Emerging Tech Risks: Strategies for Leaders

AI's workforce revolution, and the secrets of navigating emerging tech risks —discover how rising leaders stay ahead in a rapidly reshaping world.

In this Issue

1️⃣ AGI is Here...Almost:

OpenAI claims they now know how to create Artificial General Intelligence (AGI) and foresee AI agents joining the workforce by 2025, fundamentally reshaping productivity. 🤖💼

2️⃣ Workforce Shift Ahead:

AI and automation are taking over operations, shrinking traditional roles, and expanding opportunities in innovation, strategy, and AI governance. Are we prepared for this shift? 🌐⚙️

3️⃣ AI Partnerships for the Future:

OpenAI, Oracle, and SoftBank announced the "Stargate" AI Infrastructure Project, aiming to revolutionize data centers and leverage AI to address key issues like healthcare. 🛰️🏥

4️⃣ Crypto: Boom or Bust?

Memecoins like $TRUMP surged but raised concerns about fairness and sustainability. Meanwhile, Solana demonstrated its resilience under pressure, prompting crypto investors to rethink strategies. 📈💰

5️⃣ Emerging Tech & Risk Phases:

Understanding the four phases of tech adoption—Experimentation, Stabilization, Adoption, and Absorption—is critical for change leaders to drive influence and navigate stakeholder concerns. 🚀🔄

[emerging tech]

AGI: We have the recipe but are we ready?

Sam Altman says - in his reflection on ChatGPT's 2nd birthday - OpenAI now knows how to create Artificial General Intelligence (AGI):

We are now confident we know how to build AGI as we have traditionally understood it. We believe that, in 2025, we may see the first AI agents “join the workforce” and materially change the output of companies. We continue to believe that iteratively putting great tools in the hands of people leads to great, broadly-distributed outcomes.

Are we ready for how AI will reshape the workforce?

Moving workers out of operations/execution

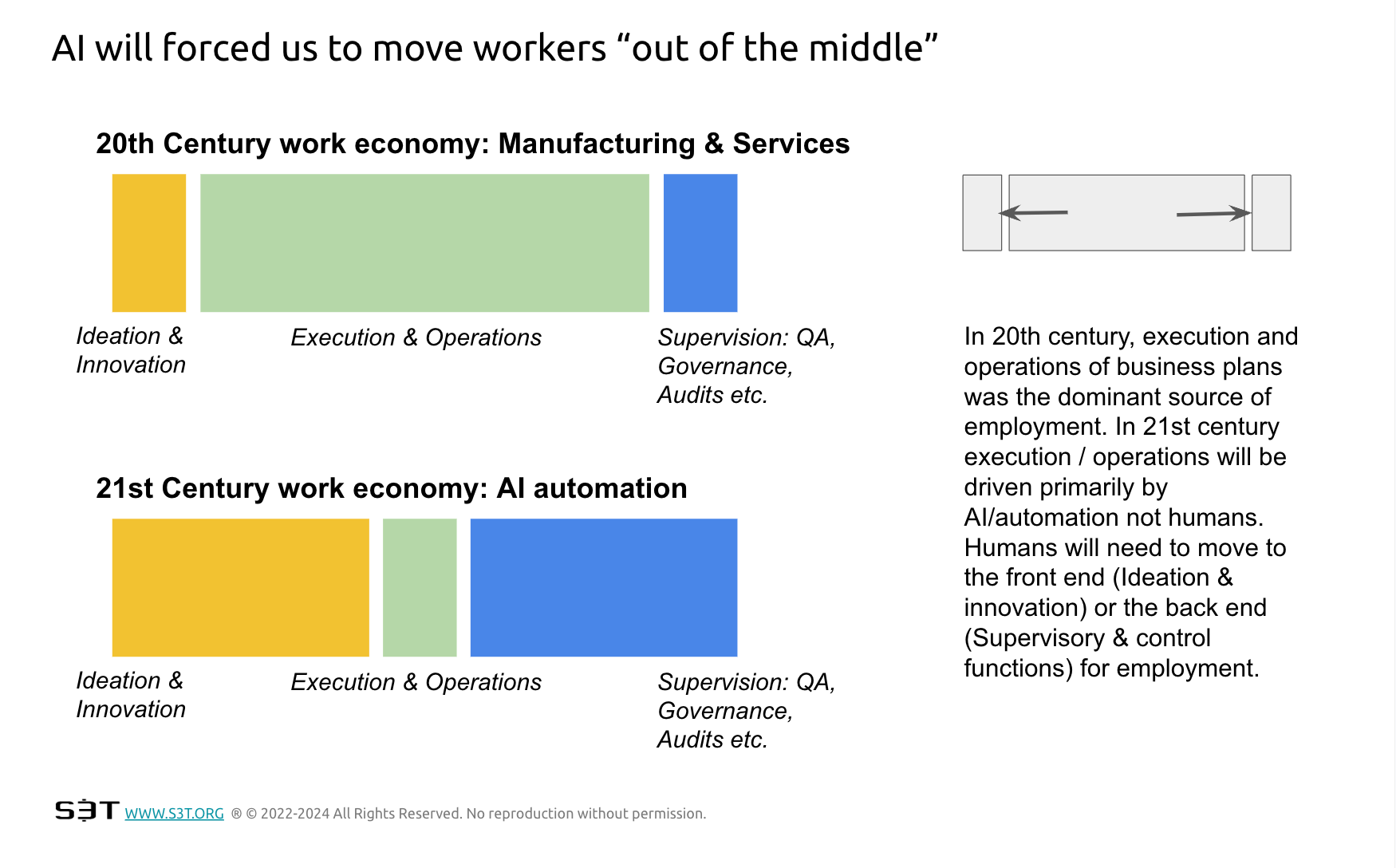

In the 20th century, jobs were predominantly focused on execution and operations. A relatively small group of innovators created plans that were carried out by a massive workforce handling operational processes, manufacturing, and service delivery.

The 21st century is rewriting this script. AI, robotics, and automation are rapidly taking over execution and operational tasks. This shift is shrinking the job market for traditional operational roles and radically altering workforce composition.

Here’s what’s emerging:

1️⃣ Front-End Growth: Opportunities in ideation, innovation, and entrepreneurship are expanding. Humans are uniquely equipped to generate new ideas and push creative boundaries.

2️⃣ Back-End Expansion: Supervisory roles are growing to ensure the safe and ethical use of AI. Functions like AI governance, safety testing, audits, and compliance are becoming critical.

What's shrinking - quickly - is the middle: Execution and operations are becoming domains of AI and automation, leaving humans to lead in creativity, control, and strategy.

Are you ready to adapt? Educators and Executives alike need to consider how to move workers out of the middle and into the front end or back end functions.

Are we ready to restrain AI if we need to: AI Capability Control

A good general explanation of approaches for monitoring and controlling the behavior and impact of AI systems is taking shape on Wikipedia. Latest version here is worth a read & bookmark.

Notes on the use of self-training on the path to AGI and super-intelligence from the LessWrong forum:

Every problem that an o1 solves is now a training data point for an o3 (eg. any o1 session which finally stumbles into the right answer can be refined to drop the dead ends and produce a clean transcript to train a more refined intuition).

The piece also notes that Inference-time search (tuning to improve a model's outputs without changing the model itself) is a useful and quick way to enhance the performance of a language model during deployment, but cannot fundamentally overcome the limitations of a model's training.

OpenAI, Oracle and SoftBank partner on "Stargate" AI Infrastructure Project

The three companies announced the initiative at the White House this week. The company leaders - interestingly - mentioned the ability of AI to help address healthcare issues, with Larry Ellison noting a connection to digital health records.

OpenAI's announcement here. OpenAI is asking interested partners to reach out to them by filling out this form.

"we want to connect with firms across the built data center infrastructure landscape, from power and land to construction to equipment, and everything in between" - OpenAI announcement

Multiple reports suggest the project actually started in 2024 as plans for a supercomputer named "Stargate" were taking shape between Microsoft and OpenAI. In late 2024 OpenAI pitched the White House the idea of building large data centers in multiple states.

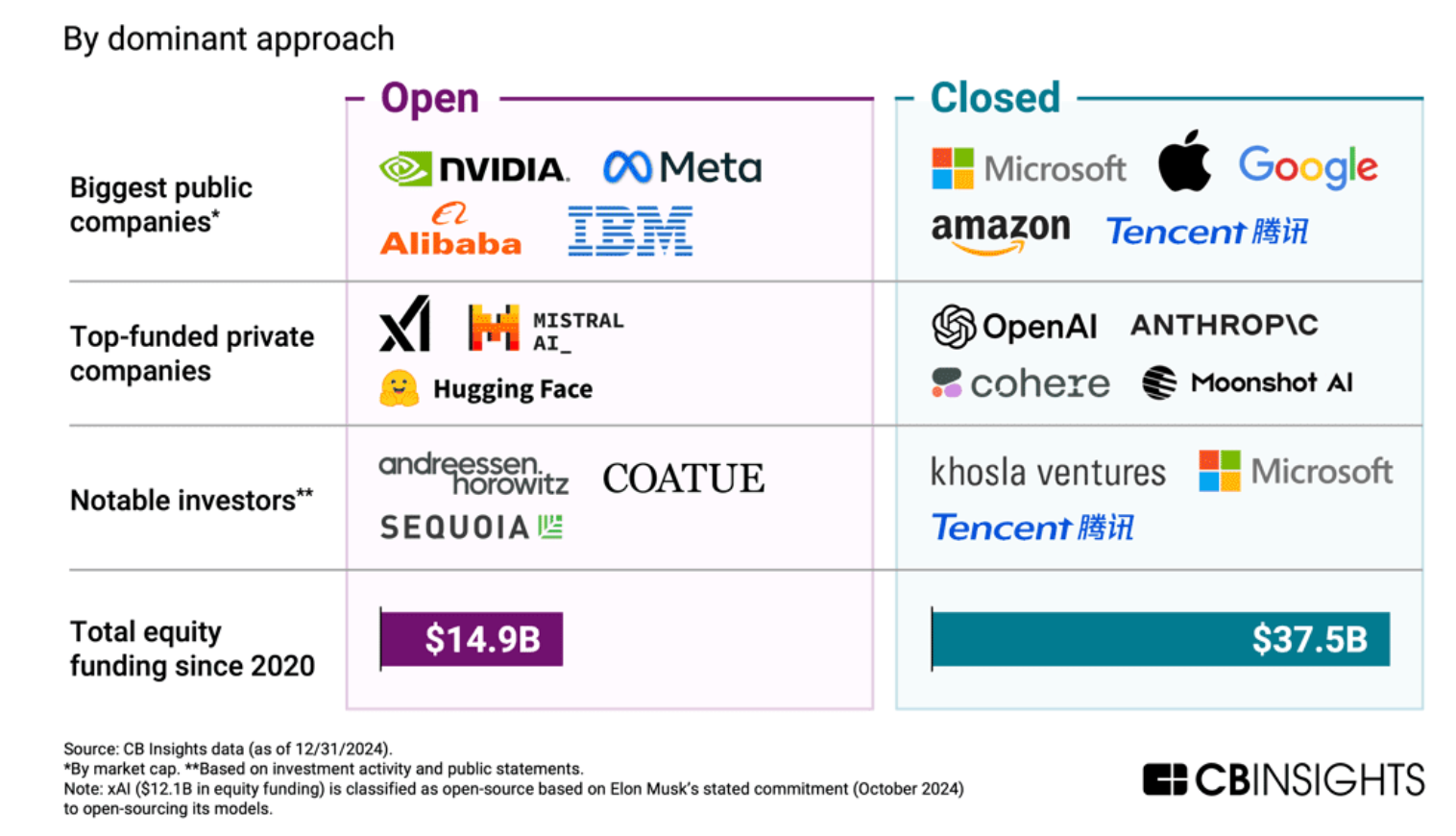

AI's Open vs Closed Models

[economics]

Full Access Members: See the S3T Economic Dashboard for the Top 500+ US & International real-time economic indicators.

Trump Family Memecoins: The Good, the Bad and Let's hope it doesn't get Ugly

Just before the inauguration CICD Digital launched a $TRUMP coin, which saw unprecedented surge in price, rising to become ~90% of Trump's total net worth. A subsequent Melania coin seemed to have a negative impact(?) with the values of both coins falling.

In the weeks since the 2024 election, there seemed to be a rising confidence that crypto's worst days were over. The incoming administration had signaled it was strongly pro-crypto and Gary Gensler was leaving the SEC. Finally - the narrative went - tech talent in the US will be allowed to unleash a new era of innovation that will improve financial equity and efficiency, and establish the US as an essential economic leader and cornerstone of global trade for decades if not centuries to come. That bright narrative has now been thrown into question.

The Good:

The weekend was a stress test of the Solana network: 4 Billion stable coins came into Solana less than 48 hrs. Solana showed its ability to handle crushing loads of transactions. Personally I expect that Solana will be a first pick for high volume projects going forward. This will likely prompt 2 things:

- Portfolio rebalancing from crypto investors who were betting on which chains will win out. Solana has further cemented its place on the short list of essential blockchains.

- A rethinking of Ethereum's strategic roadmap ("Rollups would have never been able to handle this load" was the way one insider put it),

The weekend also saw a jump in adoption of crypto wallets: Moonshot (the official referred app for buying and trading $TRUMP coin) became one of the top apps on the mobile app stores...bringing a huge new group of users to non-centralized exchange wallets. This is interesting...to date the conventional wisdom has been that regular consumers will never "hold their own crypto" in their own wallets because crypto wallets are too hard to use. This assured centralized exchanges like Coinbase that they will always be the retail investor's go to choice. That may be subject to change if personal wallets like Moonshot continue to gain adoption.

But will this be good for crypto? Maybe not...

In this Unchained podcast panel discussion of crypto insiders, sentiment was wary, and on certain points pessimistic, amid several concerns:

- That the $TRUMP coin will be perceived as a "grifty" memecoin stunt that takes money from non-savvy retail investors and puts it into the wallets of billionaires. This perception, especially if reinforced by documented harm to retail investors who bought $TRUMP coin, could hinder the establishment of balanced fair regulations for crypto.

- The potential to turn into a negative experience for retail investors: CICD Digital (and apparently Trump) hold the majority of the coin supply (80+ percent). The unlocks (a provision allowing CICD/Trump to start selling their coins at the market price) start 3 months for now...this will most likely cause the price to drop...meaning the retail investors who paid $30, $40 or more for $TRUMP coins will likely see the price plummet to $20 or lower. This is very very common among memecoins.

- That the $TRUMP coin and its aftermath could distract from the more important policy work, figuring out fair sustainable regulations, permission-less money, the relationship between Bitcoin and US Gov, etc. (Michael Taylor and Trump cabinet members met to discuss, but this news was overshadowed by hoopla around the $TRUMP coin.

In summary, the launch of these memecoins - by an incoming President no less does seem to signal that a new era of financial innovation has begun. The question is, how serious and beneficial will it actually be?

[S3T panoramas]

S3T Panoramas are publications that help leaders connect dots between large trends, identify indicators and place them in a framework.

[change leadership learning series]

This week's lesson: 4 Phases of risk & reward for emerging tech

Effective change leaders understand (and leverage) the 4 phase process of how "the New & Unfamiliar" becomes "Accepted & Familiar" over time.

Understanding these four phases isn’t just useful; it’s essential. It will help you anticipate the kinds of concerns that your stakeholders will raise when you propose a bold idea.

Different categories of investors and stakeholders have different levels of tolerance for different phases. Some with high risk tolerance will prefer to be involved as early as possible. Others will prefer to get on board later. We will examine why this is, and how you can use this understanding to increase your ability to influence and drive change.

Click the link above to access this week's lesson. You can also access an overview of the full Change Leadership Learning Series here.

[S3T playbooks]

- Spend Wisely in a Hype-Driven World

- Gaining Buy-in for Data Modernization

- Flipping the Script: Understanding and Changing Internal & Macro Narratives

- Shift to effective gatekeeping in the age of generative AI

- How to Stop Zombie Projects from Sapping your Focus and Resources

- Harmonize Different Kinds of Expertise to Achieve Success

- Addressing issues related to uneven accountability

- Validating AI use cases

- 6 Proven Ways to Resolve Conflicts

See Full List of S3T Playbooks

Opinions expressed are those of the individuals and do not reflect the official positions of companies or organizations those individuals may be affiliated with. Not financial, investment or legal advice, and no offers for securities or investment opportunities are intended. Mentions should not be construed as endorsements. Authors or guests may hold assets discussed or may have interests in companies mentioned.

Member discussion